Introduction

Unplanned asset failures can grind operations to a halt and drive up costs. In fact, about 70% of companies report losing productivity due to unexpected asset repairs or replacements. Asset lifecycle planning (also known as asset life cycle planning) is the proactive strategy to avoid such surprises by managing each asset from purchase through maintenance to final disposal for maximum return on investment (ROI).

>Explore best practices in asset lifecycle planning and management in our full ALM guide

By planning an asset’s full lifecycle in advance, organizations can save money, prevent downtime, and make data-driven decisions aligned with financial goals. This article explains what asset lifecycle planning is, why it’s important, how to implement it, and key best practices.

What is Asset Lifecycle Planning? (Definition)

Asset lifecycle planning means managing an asset from acquisition to disposal in order to maximize its useful life and value. It involves planning for every stage of the asset’s life – from purchase, to operation and maintenance, to final replacement or disposal – so the asset stays efficient and cost-effective throughout its lifespan.

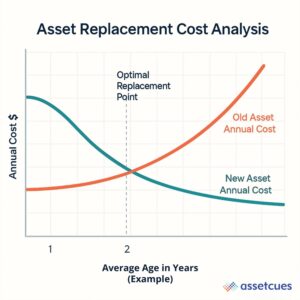

The goal is to replace assets at the optimal time to maximize ROI—avoiding both premature replacement and costly breakdowns. Focusing on asset life cycle cost—the total expense of owning, operating, maintaining, and disposing—gives managers a clear view of each asset’s true financial impact, enabling smarter maintenance and replacement decisions.

Why Plan the Full Asset Lifecycle for ROI?

Planning an asset’s full lifecycle brings major financial and operational benefits. It directly boosts ROI by ensuring you get maximum value from each asset for the lowest total cost. Proactively scheduling maintenance and replacements means fewer surprise failures, smoother budgeting, and more efficient use of assets.

Key benefits of asset lifecycle planning include:

-

Lower Costs & Budget Stability:

Optimizing maintenance schedules and timing asset replacements lowers overall ownership costs and helps you avoid expensive reactive fixes. It also spreads out big expenses to prevent sudden budget shocks when equipment needs replacing.

-

Higher Uptime & Longer Asset Life:

Maintaining and replacing equipment on schedule leads to fewer unexpected breakdowns and disruptions. Proper care also extends an asset’s useful life, so you get more productive years from each asset without added risk or cost.

-

Risk Control & Compliance:

Proactively retiring or upgrading assets before they become safety hazards or fall out of compliance protects your organization. For example, replacing an aging generator before it fails (or violates emissions rules) helps you avoid accidents, downtime, and regulatory penalties.

In short, enterprises that plan an asset’s full life cycle experience lower costs, fewer surprises, and higher returns. Strong lifecycle practices significantly cut emergency repairs and downtime, ensuring every asset delivers maximum value while saving the organization money.

Explore how finance and audit teams can streamline asset lifecycle management>>

How Do I Plan for an Asset’s Full Lifecycle Before Buying?

To plan an asset’s full lifecycle before purchase, assess its total cost of ownership and expected lifespan in advance. Factor in purchase price, maintenance needs, operating costs, and end-of-life disposal or salvage. Set a maintenance schedule and target replacement date beforehand, focusing on long-term value over the lowest upfront cost.

When evaluating a potential asset purchase, proactive asset life cycle planning means asking key questions about the asset’s future. Consider factors such as:

-

Total Cost of Ownership (TCO):

Look beyond the initial price tag to all the ongoing costs. How much energy will it consume? What do consumables (fuel, ink, etc.) cost? Are there maintenance contracts or costly spare parts? A “cheap” machine with high operating or maintenance costs can end up costing more over its life than a pricier, energy-efficient model.

-

Expected Lifespan & Durability:

Check the asset’s expected lifespan and durability by reviewing the manufacturer’s warranty, projected life, and mean time between failures (MTBF). For example, if Machine A lasts 5 years and Machine B lasts 8, the longer life can greatly increase long-term value and improve ROI.

-

Maintenance Requirements:

Understand what kind of upkeep the asset will need and how often. Does it require frequent servicing or expensive part replacements after a certain amount of use? Factor in the schedule and cost of routine maintenance and repairs – an asset that needs constant expert servicing will have a higher life cycle cost.

According to a Forbes article , unplanned downtime can cost businesses far more than they expect, making it essential to account for maintenance schedules and potential service costs upfront.

By planning an asset’s full lifecycle at purchase, you can choose the option with the best long-term ROI, not just the lowest upfront cost. This often requires cross-department collaboration. Finance can project multi-year costs, while operations and IT assess performance and durability. This ensures the asset meets long-term needs without unexpected expenses or premature failure.

What Is the Best Way to Budget for Asset Replacement?

The best approach is to treat replacements as a planned expense and save up over each asset’s life. By the time an asset reaches the end of its useful life, you’ll have funds set aside to replace it with no budget shock.

-

Establish Reserve Funds:

Create a dedicated reserve for asset renewal by allocating a portion of each asset’s cost annually. For example, for a 5-year asset, set aside about one-fifth of its cost each year so that by year five, you’ve covered the full replacement amount—making spending predictable and avoiding large lump-sum expenses.

-

Prioritize Critical Assets:

When budgets are tight, prioritize replacing mission-critical assets essential to operations or safety. Ensure reserves cover core equipment—such as key machinery, vehicles, or servers—whose failure would cause major disruption. Schedule less critical assets later, aligning spending with risk so high-risk assets have replacement funds secured early.

-

Plan, Don’t React:

Avoid costly emergency purchases by planning replacements in advance. A proactive approach lets you secure the best price and schedule work at convenient times, while reactive replacements typically cost more and cause greater downtime. In nearly every case, planned replacements are cheaper and smoother than urgent, unplanned ones.

Consider using asset management software to support budgeting by tracking each asset’s age and condition, flagging upcoming end-of-life, and estimating replacement timelines. Integrating these insights into financial planning ensures you’re prepared for asset renewal costs well in advance.

How to Develop an Asset Lifecycle Management Plan (Step-by-Step)

A formal asset lifecycle management plan turns these ideas into an actionable program for your organization. Key steps include:

Step 1: Inventory Your Assets

List all assets and document key details (purchase date, cost, age, condition, usage, maintenance history, etc.). This comprehensive inventory is the foundation of your plan.

Step 2: Define Lifecycle Policies

Set clear maintenance rules and replacement criteria for each asset. Define maintenance intervals by asset category and use cost or age thresholds to determine when repair is viable versus when replacement is the better option.

Step 3: Calculate Life Cycle Costs

Analyze the total life cycle cost of each asset – including purchase, operating, maintenance, and end-of-life costs. Understanding each asset’s true total cost helps identify when keeping it becomes more expensive than replacing it.

Step 4: Plan Maintenance and Replacement Schedules

Schedule routine maintenance for every asset and assign a target replacement date. Map these out in a multi-year asset replacement schedule so you know in advance when each asset is nearing end-of-life.

Step 5: Implement Tracking Tools

Use asset management software or other tools to track the plan. Automation can send maintenance reminders, flag upcoming replacement dates, and keep all asset information in one place so nothing gets overlooked.

Step 6: Review and Optimize Regularly

Periodically review the plan (e.g. annually) and update it based on real-world results. Adjust maintenance or replacement timelines as needed if assets are lasting longer or shorter than expected, and incorporate new business needs or technologies.

Explore the key stages of the asset lifecycle>>

Frequently Asked Questions (FAQ)

Q: What is asset lifecycle planning?

A: Asset lifecycle planning means planning for each stage of an asset’s life to keep it productive as long as possible. This involves acquiring appropriate assets, scheduling maintenance, and retiring assets at the right time. Good planning lets Finance budget ahead, IT optimize maintenance, and Audit manage asset transitions smoothly.

Q: What should an asset lifecycle management plan include?

A: An asset lifecycle management plan should track all assets with key details like age, condition, and value, outline maintenance schedules, set clear repair-versus-replace criteria, and forecast replacement timelines and costs. It serves as a roadmap for managing each asset from purchase to disposal, including budgeting for upkeep and replacement.

Q: How do I determine when an asset needs to be replaced?

A: Replace an asset when it nears the end of its useful life, its performance declines, or maintenance costs rise sharply year over year. A key rule: if the yearly cost of keeping it (maintenance + downtime) exceeds the annualized cost of a new one, it’s time to upgrade. Asset monitoring and lifecycle cost analysis data can pinpoint the ideal replacement moment.

Q: What is the life cycle cost of an asset?

A: The life cycle cost of an asset (Total Cost of Ownership) is the sum of all costs the asset incurs over its life. It includes purchase, installation, operation, maintenance, and disposal costs. Knowing this metric helps Finance evaluate ROI, guides IT budgeting, and ensures Audit covers all asset expenses.

Conclusion & Call to Action

Asset lifecycle planning enables organizations to maximize ROI, reduce unexpected costs, and ensure smooth operations. By managing each stage—from purchase to retirement—you can minimize downtime, replace equipment at the optimal time, and maintain predictable finances.

If your team has been reacting to equipment failures, now is the time to adopt a proactive lifecycle plan. Starting with just one asset category—such as IT hardware or your vehicle fleet—can quickly deliver cost savings, improve uptime, and reduce last-minute crises. Even small planning steps can lead to significant gains.

Modern asset management tools (like AssetCues) streamline operations by tracking assets, scheduling maintenance, and forecasting replacements through data-driven insights. Adopting a proactive strategy with the right tools ensures long-term efficiency, maximizes ROI, and minimizes unexpected issues across your asset portfolio.