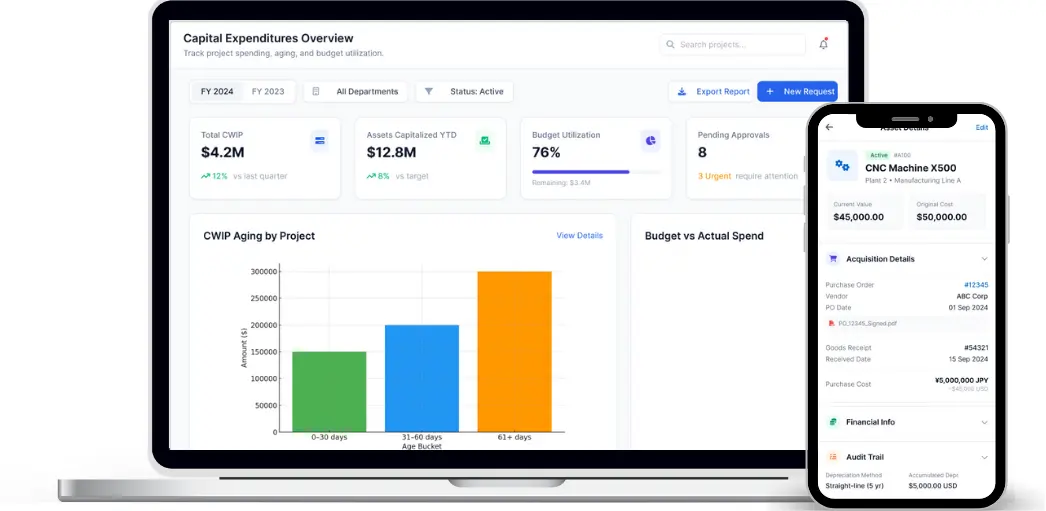

Asset Capitalization Software

Capitalize Smarter.

Close Faster

Automate asset capitalization, enforce policies, and accelerate your financial close with confidence.

Automated Fixed Asset Capitalization with AssetCues

Manual capitalization creates inconsistencies, compliance risks, and delays in financial close; AssetCues automates fixed asset capitalization, embedding policy-based controls that ensure accuracy, compliance, and audit readiness.

Policy

Compliance

Audit Transparency

Process Efficiency

Core Features

Engineered for End-to-End CIP Visibility and Policy-Driven Capitalization

Construction-in-Progress (CIP) Tracking

Monitors ongoing project assets until completion.

Placed-in-Service Validation

Confirms readiness and compliance before asset activation.

Capitalization Policy Engine

Automates asset capitalization based on company policies

Audit-Ready Evidence Trail

Every transaction is documented with timestamps and supporting files, creating a transparent, verifiable audit trail that ensures compliance and accountability.

ERP Integration

Seamlessly connects with SAP, Oracle, NetSuite, and Microsoft Dynamics to synchronize asset data and eliminate manual data entry errors.

Automated Policy Enforcement

Applies capitalization rules, thresholds, and useful-life policies automatically, ensuring consistent and compliant asset treatment across all transactions.

Real-Time Asset Tracking

Provides instant visibility into asset status, from purchase through in-service date, enabling timely depreciation and accurate financial reporting.

Additional Features

Trusted by leading Finance & Audit teams worldwide

Benefits

Seamless, Compliant Asset Movement with AssetCues

Month-end and year-end are stressful enough without chasing capitalization errors. AssetCues takes the manual work off your team’s plate, applies policies automatically, and makes sure depreciation starts when it should. Leading to a smoother, on-time close.

Applying GAAP or IFRS rules by hand is a recipe for mistakes. With AssetCues, every transaction follows the same set of capitalization rules, no matter who enters it or where it’s recorded. Finance leaders are assured that CapEx and OpEx are treated consistently across the business.

Auditors want evidence, not explanations. AssetCues automatically attaches approvals, documents, and time-stamped proof, making every capitalization decision transparent and defensible.

Finance teams shouldn’t waste time reconciling between systems. AssetCues integrates bi-directionally with SAP, Oracle, Microsoft Dynamics, and NetSuite to keep fixed asset registers and general ledgers aligned automatically.

By reducing rework, eliminating manual reconciliations, and cutting reliance on external consultants, AssetCues lowers the overall cost of maintaining accurate and compliant fixed asset records.

Ready to align your physical assets with your financial truth?

Apply Capitalization Policy at Acquisition

Automate CapEx versus OpEx classification using predefined rules, ensuring consistent, compliant decisions from the moment an asset is acquired across your organization.

Track and Capitalize Construction-in-Progress (CIP)

Monitor active project costs in real time, enabling accurate roll-ups, smoother transitions to capitalization, and complete visibility into every stage of project spending.

Maintain Audit-Ready Capitalization Records

Begin depreciation only when supporting evidence is verified, preserving data accuracy, strengthening compliance, and ensuring every capitalized asset meets audit standards confidently.

Use Case

Key Use Cases for Asset Capitalization

Trusted by Leaders, Built for Scale

Happy

Users

Million Assets

Tracked

Years of

Experience

Countries,

where used

Integration

Seamlessly Synced With Your Core Systems

Prebuilt integrations with leading ERPs, ITSM/CMDB, IT discovery Tools and HRMS systems for a single source of asset truth.

Insights & Information

Ready to make capitalization consistent and auditable?

FAQs

How does AssetCues help track assets across their lifecycle?

1.AssetCues provides fixed asset management software that monitors assets from purchase through depreciation and disposal. With tagging, centralized records, and automated updates, AssetCues eliminates spreadsheet dependency and ensures every stage of the lifecycle is audit-ready.

How does AssetCues automate asset capitalization?

AssetCues applies your capitalization policy automatically, enforcing thresholds, useful lives, and CapEx vs OpEx rules. This removes guesswork, ensures consistency across entities, and guarantees that every asset is capitalized in line with GAAP and IFRS standards.

How does AssetCues handle Construction-in-Progress (CIP)?

AssetCues tracks all costs related to Construction-in-Progress, from labor and materials to installation charges. When an asset is ready for use, CIP balances are rolled seamlessly into the fixed asset register, and depreciation begins on schedule.

What types of assets can AssetCues manage?

AssetCues manages all fixed assets, including IT hardware, machinery, vehicles, equipment, and office infrastructure. Its flexible repository and tracking options – barcode, RFID, or IoT, make it suitable for organizations of any size or industry.

Does AssetCues integrate with ERP and IT systems?

AssetCues integrates seamlessly with major ERP systems like SAP, Oracle, and Microsoft Dynamics, as well as ITSM tools. This synchronization ensures financial, IT, and facilities teams always work with consistent, up-to-date asset information.