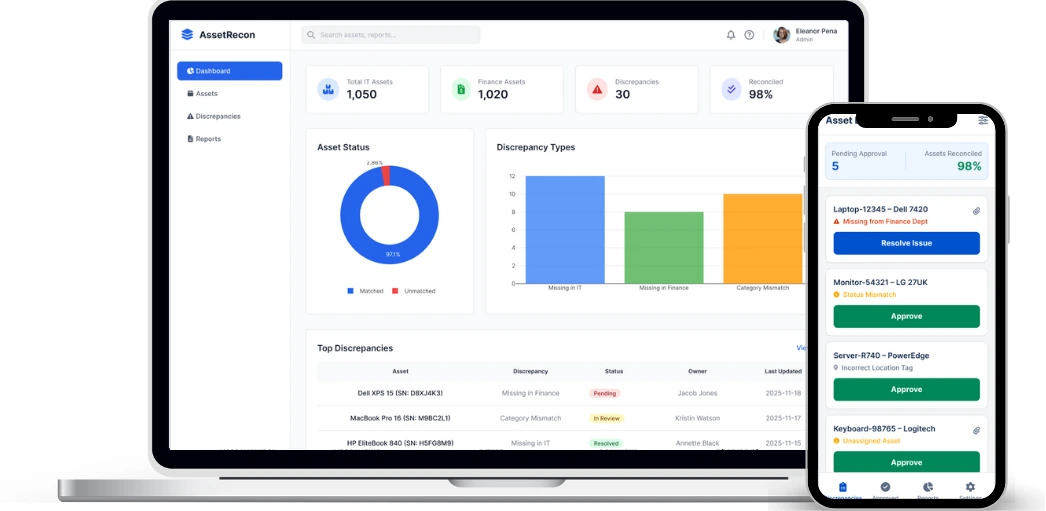

Asset Reconciliation Software

Reconcile every asset, every time-faster, smarter, audit ready

One platform to reconcile every asset: barcode to IoT, mobile to AI-accurate, compliant, and audit-ready

Turning Reconciliation into a Seamless Process with AssetCues

IT and Finance teams struggle with fragmented systems, outdated records, and costly mismatches between inventories and the Fixed Asset Register.AssetCues unifies all assets into a single source of truth, automating reconciliation through AI, IoT, and ERP/CMDB integrations to deliver a seamless, audit-ready process.

Data

Accuracy

Audit Readiness

Operational Efficiency

Core Features

Complete Lifecycle Control With Intelligent Reconciliation and Real-Time Capture

Custody & Lifecycle Management

Tracks ownership and usage through complete asset lifecycle.

Reconciliation Engine & Analytics

Automates asset matching with insightful discrepancy analytics.

Mobile, RFID & IoT Capture

Enables seamless real-time data collection across technologies.

Retirement & Disposal Records

Maintains complete, tamper-proof documentation of asset retirements and disposals, ensuring compliance, traceability, and audit readiness.

Policy-Driven Audits & Compliance

Enforces audit-ready processes through automated checks and configurable compliance rules.

Warranty, AMC & Software License Control

Tracks warranty timelines, maintenance contracts, and license expirations to optimize renewals and reduce risk.

Software License Reconciliation

Automatically matches installed software with purchased licenses to eliminate compliance gaps and overspending.

Analytics & Dashboards

Delivers real-time visibility into asset utilization, compliance status, and cost trends for informed decision-making.

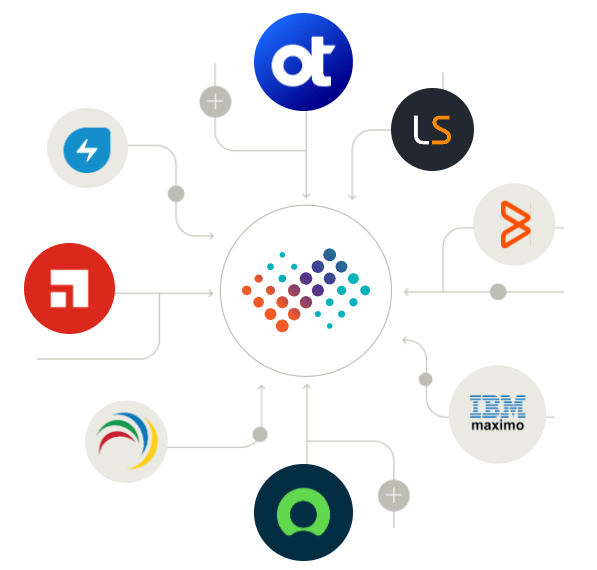

Integrations

Connects seamlessly with ERP, CMDB, and ITSM systems to ensure consistent, synchronized asset data across the enterprise.

Additional Features

Enhanced Capabilities That Improve Accuracy and Streamline IT Governance

Trusted by leading IT teams worldwide

Benefits

AssetCues: The Standard for Reliable Asset Reconciliation

With AssetCues, IT leaders can finally close the gap between their fixed asset register and on-the-ground reality. Customers consistently achieve 100% audit coverage - every laptop, server, and peripheral is tracked, reconciled, and verified with up-to-date registers that eliminate ghost assets and data drift.

What once took weeks of manual effort can now be completed in a fraction of the time. Enterprises report 50-70% faster audits and 70%+ reduction in verification effort, freeing IT teams from endless reconciliations so they can focus on higher-value initiatives.

Audits no longer need to trigger anxiety. AssetCues provides geo-tagged photos, custody trails, user acknowledgements, and evidence-rich reports that stand up to the toughest internal and external audit scrutiny. Every variance comes with supporting proof, ensuring defensible compliance at all times.

Whether managing 1,000 assets in a single site or 100,000+ endpoints across multiple geographies, AssetCues is built to scale. IT leaders trust it to reconcile assets across multi-site, hybrid workforce environments, without compromising accuracy or performance.

AssetCues doesn’t just solve today’s reconciliation challenges, it prepares IT teams for the future. From barcode and RFID to IoT sensors, BLE, AI anomaly detection, and predictive analytics, the platform

Ready to reconcile every asset with accuracy, speed, and audit confidence.

File-to-Floor Audits

Verify listed assets against actual physical inventory, identify discrepancies instantly, and streamline compliance by ensuring the register accurately reflects every asset on the floor.

Continuous Reconciliation

Keep asset records continuously aligned with real-world status, maintaining perfect sync between the register and physical floor to eliminate gaps and prevent costly inaccuracies.

End-to-End Reconciliation

Capture every asset event—from movement and reassignment to retirement and disposal—ensuring complete traceability and maintaining accurate, audit-ready records throughout the lifecycle.

Use Case

Real-World Asset Reconciliation Made Easy with AssetCues

Trusted by Leaders, Built for Scale

Happy

Users

Million Assets

Tracked

Years of

Experience

Countries,

where used

Integration

Seamlessly Synced With Your Core Systems

Prebuilt integrations with leading ERPs,

ITSM/CMDB, IT discovery Tools and HRMS systems for a single source of asset truth.

Insights & Information

Experience Smarter Reconciliation with AssetCues

FAQs

What is asset reconciliation and why is it crucial?

Asset reconciliation aligns your fixed asset register with actual physical assets, surfacing discrepancies like ghost assets or missing records. It ensures financial accuracy and audit compliance by systematically validating that books match reality.

How does software simplify asset reconciliation?

AssetCues automates reconciliation by comparing scanned physical counts via mobile, IoT, or RFID against the register, instantly flagging variances and generating exception reports—far more efficient than spreadsheet-based checks.

How often should asset reconciliation be performed?

Best practice is to conduct a full reconciliation at least annually, with more frequent checks (quarterly or continuously) in high-turnover or remote environments. AssetCues supports continuous reconciliation, automatically updating records whenever assets are scanned, deployed, or retired.

Which physical verification methods support reconciliation?

Two core methods underpin reconciliation:

Wall-to-Wall (W2W): A full site sweep, ideal for baseline accuracy.

File-to-Floor (FTF): Verifying only assets listed in the register—faster and efficient. AssetCues supports both to suit different audit needs.

How do mobile apps enhance reconciliation accuracy?

Mobile-based scanning—via barcode, RFID, GPS, or BLE—helps capture asset data on the go. This speeds up verification, reduces manual error, and triggers real-time reconciliation in AssetCues.

How does reconciliation support compliance and audits?

By validating that assets truly exist, capturing condition and location data, and generating audit-ready reports, reconciliation strengthens internal controls and regulatory compliance—even satisfying IFRS or GAAP disclosure requirements.