Introduction

Many organizations lose visibility over nearly 6% of their assets each year, creating financial waste and operational blind spots. A well-structured fixed asset register prevents this by maintaining a centralized, up-to-date record of all long-term assets. For enterprises, this includes not only buildings and machinery but also IT assets such as computers, servers, networking equipment, and data center hardware.

In simple terms, an asset register acts as the single source of truth for what your organization owns, where those assets are located, who is responsible for them, and how they impact your financial statements. When maintained accurately, it enables better IT governance, faster audits, improved asset utilization, and tighter cost control.

To manage this at scale, enterprises increasingly rely on fixed asset management software that centralizes asset data, automates depreciation, and provides real-time visibility across IT and non-IT assets, ensuring accuracy, audit readiness, and compliance throughout the asset lifecycle.

Maintaining an accurate asset register is not just a best practice—it is a compliance necessity. Accounting standards such as IFRS and US GAAP require precise tracking of fixed assets and depreciation, making a reliable asset register essential for financial reporting, internal controls, and enterprise risk management.

In this guide, you will learn:

-

What a fixed asset register is and why it is crucial for financial accuracy, IT governance, and operational control.

-

Why maintaining a complete and up-to-date register matters for audits, compliance, and risk management.

-

How to create and maintain an asset register step by step, including tracking IT and enterprise assets.

-

Tools, templates, and best practices that simplify asset verification, reduce errors, and save time.

What Is a Fixed Asset Register & Why It’s Important

A fixed asset register is a detailed list of all fixed (long-term) assets a company owns, along with vital information for each item (unique ID, description, purchase date, cost, current value, location, depreciation, etc.). It serves as the authoritative ledger of the company’s owned assets and their status.

Maintaining a complete, accurate asset register is vital for sound financial reporting and control. It ensures your balance sheet reflects reality and that you can account for every significant piece of equipment, vehicle, or property your business owns. In short, the asset register tells you what assets you have, where they are, how much they’re worth, and how they change in value over time.

Key benefits of an up-to-date asset register include:

-

Financial accuracy and compliance:

It provides precise book values and depreciation calculations for your assets, preventing misstatements in financial reports. This ensures compliance with accounting standards and makes audits much easier. Auditors or tax authorities can easily verify assets against the register, reducing the risk of errors or penalties.

-

Operational efficiency:

Knowing exactly what assets you have and where they are helps avoid duplicate purchases and plan maintenance proactively. Additionally, an asset register lets teams see each asset’s location, status, and condition at a glance. Consequently, it prevents lost items and redundant purchases.

-

Risk management:

A proper register provides an audit trail for each asset, reducing the chance of missing items or “ghost assets.” Having a verified list also helps with insurance claims and regulatory audits. In short, it protects you from compliance issues, financial inaccuracies, or even unnoticed theft or loss.

The key advantages of maintaining an asset register, includes improved financial accuracy, higher operational efficiency, effective risk management, stronger audit and compliance readiness, and consistent asset tagging and tracking

Types of Asset Registers Used by Organizations

Organizations can maintain different types of asset registers depending on the asset category and business needs:

-

Fixed Asset Register: Tracks long-term tangible assets such as buildings, machinery, vehicles, and IT equipment. It focuses on financial value, depreciation, and lifecycle management.

-

IT Asset Register: Focuses specifically on technology assets—computers, servers, networking devices, and software licenses. It helps with IT governance, security, and audit readiness. For organizations managing IT infrastructure, an it asset register provides a centralized record of all technology assets, helping track hardware, software, and network devices efficiently.

-

Operational Asset Register: Records assets used in day-to-day operations, such as tools, office equipment, and production machinery. It emphasizes location, status, and maintenance schedules.

-

Leased or Rented Asset Register: Tracks assets that are leased or rented, including contract terms, payment schedules, and return conditions, ensuring compliance with accounting standards.

Each type serves a specific purpose, but all provide a centralized source of truth that supports asset tracking, financial reporting, and operational control.

Key Components of an Effective Asset Register

Before creating your register, it’s crucial to decide what data to capture for each asset. A good asset register includes all the information needed to identify an asset, value it properly, and manage it through its life cycle. Key components (fields) that every effective asset register should include are:

-

Unique Asset ID:

A unique code or number for each asset (often also attached as a physical tag). For example, a laptop might be ID IT-1001, a vehicle VEH-2025, etc. Consistent, unique IDs prevent confusion and make it easy to reference and track assets.

-

Asset Name & Description:

Record a clear name for the asset along with its category (e.g., a Dell laptop under IT Equipment). Include any key identifiers like model or serial number to uniquely distinguish the item (useful for support and warranty).

-

Location & Custodian:

Where the asset is located and who is responsible for it. For example, “London Office – 3rd Floor (Custodian: IT Department)”. This adds accountability and makes it easier to find assets during audits or if something needs servicing.

-

Purchase Date & Cost:

When the asset was acquired and how much was paid for it. For example, “Purchased Jan 15, 2022 for $1,200.” This provides the historical cost for accounting and marks when depreciation should begin.

-

Depreciation Method & Useful Life:

Document how the asset is depreciated and over what period (for example, straight-line over 3 years). This information is crucial for calculating depreciation expense and tracking the asset’s remaining life. Understanding how depreciation affects asset valuation helps ensure that your register accurately reflects each asset’s true financial position over time.

-

Accumulated Depreciation & Net Book Value:

These values update over time as the asset depreciates. Accumulated depreciation is the total depreciation taken to date, and net book value is the asset’s cost minus that accumulated depreciation. For instance, if a machine cost $5,000 and has $3,000 accumulated depreciation, its current book value is $2,000.

-

Maintenance & Warranty Info:

Records of any maintenance performed and the asset’s warranty status. For example, note the last service date, next service due, and warranty expiration date. This turns your register into a useful tool for operations by helping schedule maintenance and ensuring warranties are utilized.

-

Asset Status:

Note the asset’s current status (Active, In Storage, Under Repair, Retired, etc.). Keeping status updated prevents “zombie” assets lingering on your books. Once an asset is retired or disposed, mark it accordingly so it can be removed from active records.

-

Disposition Details:

If an asset is sold, scrapped, or otherwise disposed, record when and how it happened (and for how much, if sold). For example, “Disposed on July 15, 2025 – sold at auction for $5,000.” Documenting disposals provides a clear audit trail and ensures the asset is properly removed from the register and financial statements.

How to Create a Fixed Asset Register (Step-by-Step Guide)

So, how do you create an asset register for your business? It involves a few clear stages: defining what assets to include, doing a physical audit to gather details, recording everything in a structured format, assigning IDs, and then reconciling with your financial records. Below is a step-by-step guide:

-

Establish asset criteria and policies

Define what counts as a fixed asset for your organization. Set a capitalization threshold—such as assets over a certain value used for over a year. Decide which categories to track (e.g., IT equipment, machinery, vehicles) and define depreciation methods and useful life for each. Document these policies so everyone knows what to record. Prepare your register format with all key fields, whether using a spreadsheet or asset management software.

-

Inventory your existing assets

Perform a physical inventory of current assets. Go through all locations with a checklist (or scanner) to identify every asset meeting your criteria. Use prior asset lists or purchase records as references, but verify each item in person. As you find assets, record their details (description, serial number, location, condition, etc.) and tag them with an ID if they aren’t already labeled. This audit often reveals assets not on any previous list and may find that some listed items are actually missing. The result is a comprehensive list of assets that will go into your register.

-

Record asset details in the register

Enter collected data into your asset register using a consistent format—standardize dates, names, and locations. Assign and label a unique ID for each asset. Double-check key data like purchase costs and dates to avoid errors. If using a spreadsheet, set up formulas to auto-calculate depreciation and book value to keep the register accurate.

-

Reconcile with financial records

Compare the total asset value in the register with the fixed asset balances in your general ledger or balance sheet—they should match. If not, identify the assets causing the discrepancy. For example, you may find assets in the ledger that weren’t found during the audit—likely disposed or lost but never removed—or assets found physically but missing from the books, possibly never capitalized. Therefore, work with your accounting team to correct these differences by adding, removing, or adjusting entries as needed. Ultimately, the goal is full alignment between the register and accounting records.

-

Implement controls and ownership

Establish processes to keep the register accurate. Assign a person or team—like a fixed asset accountant—to update it when assets are acquired, moved, or disposed. First, make department heads responsible for reporting changes. Next, define clear steps: add new assets immediately and remove disposed ones with proper documentation. Additionally, integrate updates into regular workflows. Finally, schedule periodic audits—at least annually—to verify that physical assets match records.

With your asset register now built, the next challenge is keeping it accurate over time. The following section covers how to maintain a fixed asset register effectively.

How to Maintain a Fixed Asset Register (Best Practices)

Creating an asset register is not a one-and-done task. The real value comes from keeping it accurate and up-to-date. Here are some best practices to maintain a fixed asset register so it remains reliable:

-

Regular physical audits:

Conduct a full asset verification audit at least once a year. Take your register and verify each item on the list is present in its recorded location (and in the expected condition). Investigate any discrepancies immediately. If you find an asset not in the register, add it (and figure out why it was missed). If an asset on the register can’t be located, determine if it was moved or disposed and update the records (after thorough checking, it may need to be written off). These audits prevent ghost assets and ensure your records reflect reality.

-

Prompt updates for changes:

Update the register immediately whenever an asset is purchased, transferred, or disposed. Don’t wait until later – a backlog of unrecorded changes leads to errors and forgotten updates. Make quick updating part of the process. For example, record new equipment in the register as soon as it’s deployed, and log disposals on the same day they happen. Keeping information real-time ensures the register is always accurate and audit-ready.

-

Consistent tagging and identification:

Label each asset with a physical tag (barcode, QR code, or RFID) and a unique ID that links to its record in the register. Use one standardized tagging system across the organization. This allows you to scan assets during audits for quick verification and helps prevent duplicate records or confusion. Align the register with IT asset tracking as well – ensure the IT department’s inventory of devices matches the finance department’s asset register. This unified approach also supports compliance (for example, ISO 27001 requires a clear inventory of information assets, which your IT asset register provides).

-

Keep depreciation data updated:

Update depreciation and asset values on a regular schedule (monthly or quarterly). Don’t wait until year-end – keep accumulated depreciation and book values current throughout the year. Also record any impairments or revaluations promptly if an asset’s value changes significantly (say an asset is damaged or its market value is adjusted). Regularly updating these financial details means your register’s numbers will consistently match your accounting books, preventing last-minute surprises.

-

Clear ownership and accountability:

Make individuals accountable for keeping asset information up to date. Assign an “owner” or custodian for each asset or asset category (for example, the IT manager for IT equipment, the fleet manager for vehicles). Also designate someone in finance as the overall asset register administrator to coordinate updates across departments. Ensure everyone understands why accuracy matters (explain how lost assets or bad records could affect finances or insurance). When people know their role and the importance of accurate data, they are more likely to follow the procedures.

-

Leverage technology and automation:

Use software tools to simplify asset management. With many assets, choose a dedicated register system over spreadsheets. Effectively, good software automates depreciation, enforces data rules, and keeps an audit trail. Moreover, many support mobile barcode scanning for quick audits. Modern tools also integrate with purchasing or IT systems to auto-update asset records. This reduces errors and saves time. A detailed comparison between spreadsheets and a proper asset register system highlights when upgrading is essential.

Asset Register Template and Example (Practical How-To)

You don’t have to start from scratch when building an asset register. Many free fixed asset register templates and examples (usually Excel-based) are available.

A good template will include columns for all the key fields (asset ID, name, category, purchase date, cost, depreciation method, useful life, current value, location, custodian, status, etc.) and often comes with example data and formulas built in. Starting with a template ensures you don’t overlook important information and keeps your data organized in a consistent format. Detailed asset register examples and excel templates provide ready-to-use formats to help you build an accurate and complete register efficiently.

Common Mistakes in Asset Registers (and How to Avoid Them)

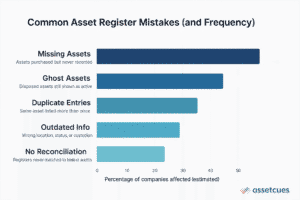

Even with the best intentions, companies often make mistakes when managing asset registers. Here are some common asset register mistakes and ways to avoid them:

-

Missing assets:

Some assets go unrecorded—like equipment a department buys without informing finance—causing incomplete lists and understated values. Regular audits and a policy to log all new purchases help prevent this.

-

Outdated records:

Assets that were sold, scrapped, or lost still appear as active in the register. These “ghost assets” inflate your asset count and distort depreciation. Promptly updating the register after any disposal, and doing periodic physical inventories, prevents this issue.

-

Duplicate or inconsistent entries:

The same asset might be listed twice under slightly different names, or data is entered in inconsistent ways. Duplicates cause overstatement and confusion. Enforcing unique asset IDs and standard naming conventions (and searching the register before adding new entries) resolves this problem.

-

No reconciliation or audit:

If you never compare the register with your financial ledgers or fail to do physical checks, discrepancies will accumulate. Over time, the books and reality can drift far apart. Regular reconciliation and periodic audits are essential to catch and correct errors early.

Common asset register errors include missing, ghost, and duplicate assets, as well as outdated records and poor reconciliation. These issues occur frequently and undermine data accuracy, audit reliability, and financial reporting.

The Future of Asset Registers – Trends & Innovations

Asset registers are becoming smarter and more connected thanks to new technology. Looking ahead, several trends are likely to shape the future of asset register management:

-

Automation and AI:

Automation and AI will help populate and verify asset data (for instance, auto-creating records from invoices or detecting unused assets). Routine tasks will increasingly be handled by intelligent software.

-

IoT and real-time tracking:

With Internet of Things sensors, assets can report their own status and location. GPS trackers, RFID tags, or smart devices on equipment will update the register in real time whenever an asset moves or changes status. This continuous tracking reduces the need for large annual audits.

-

Integrated, cloud-based systems:

Cloud-based systems that integrate finance, maintenance, and operations data are on the rise. Users will be able to access and update asset info from anywhere, and all asset details will be unified in one platform.

future asset registers will require less manual effort as they become more automated, real-time, and closely integrated with other systems. Companies that invest in modernizing their asset tracking will find it easier to keep records accurate and up-to-date, while gaining more insights from their asset data.

Key Takeaways:

-

Maintaining a fixed asset register ensures accurate financial reporting, operational efficiency, and compliance with IFRS and US GAAP.

-

A register provides a single source of truth for all assets, including IT, machinery, vehicles, and property.

-

The creation process includes defining asset policies, performing a physical inventory, recording details, assigning IDs, and reconciling with financial records.

-

Regular maintenance—audits, updates, and consistent tagging—prevents errors, duplicates, and ghost assets.

-

Leveraging templates or asset management software streamlines record-keeping, automates depreciation, and improves audit readiness.

Conclusion

Maintaining a fixed asset register might not be glamorous, but it is a fundamental part of good financial management and operational control.

By following the steps and best practices outlined above, you can keep track of what your business owns, where each asset is, and how much it’s worth – with minimal headaches. If managing the register still feels overwhelming, consider using specialized tools or getting expert help.

Dedicated fixed asset software (like AssetCues) can automate much of the process and ensure nothing slips through the cracks. Whether you use a simple template or a comprehensive system, the key is to stay consistent and proactive.

With an up-to-date asset register in place, you’ll have peace of mind knowing your assets are under control, and as a result, your finance team and auditors will thank you for it.

FAQ – Frequently Asked Questions

Q1: How to create an asset register?

Ans: To create an asset register, first define which assets to include (set capitalization thresholds and categories), conduct a physical inventory, record each asset’s details (unique ID, cost, location, depreciation, etc.) in a structured register, assign IDs, and reconcile it with financial records.

Q2: Who is responsible for the fixed asset register?

Ans: Typically, a fixed asset accountant or asset manager in the finance department “owns” the register, maintaining updates for acquisitions, moves, and disposals. Department heads or asset custodians must also report any changes to ensure records stay accurate.

Q3: Is a fixed asset register mandatory?

Ans: While not explicitly mandated by law, maintaining a fixed asset register is effectively required for compliance with major accounting standards (e.g., IFRS and US GAAP). It ensures accurate tracking of assets and depreciation for audits and financial reporting.

Q4: What is the content of fixed asset register?

Ans: A fixed asset register typically contains for each asset: a unique ID, name/description, category, location and custodian, purchase date and cost, depreciation method and accumulated depreciation, current book value, status (active, disposed), and any disposal details.

Q5: What is the best practice of an asset register?

Ans: The best practice for an asset register is to keep it accurate, up to date, and centrally managed, with regular physical verification, clear asset identification, and lifecycle tracking to support compliance, audits, and informed decision-making.