Introduction

Fixed Asset Verification is the process of confirming that a company’s fixed assets actually exist and are in the condition and location recorded. In simple terms, it’s a physical asset verification to ensure your asset register reflects reality.

Learn how our Asset Verification Software can transform the physical verification and record keeping of assets>>

Neglecting this process can lead to serious issues –

- Missing Assets,

- Accounting Errors,

- Compliance Failures.

Our internal study shows that 85% of companies lack complete and accurate fixed asset records. Additionally, 25%–40% of listed assets cannot be verified due to poor identification and weak linkage with the asset register. As a result, your balance sheet may overstate non-existent assets, distorting financial reporting and asset valuation. These gaps highlight the urgent need for reliable verification and accurate record-keeping.

Regular fixed asset audits (physical counts of assets) are essential for accurate accounting, Compliance, and operational control. In this complete guide, we’ll explain what asset verification involves, why it’s important, how to carry out a physical asset verification step by step. Additionally, we show how technology—like barcodes, RFID, and software—can automate and improve the entire process.

Let’s dive in, starting with the basics.

What is Fixed Asset Verification?

Fixed Asset Verification (also called physical asset verification or an asset audit) is a systematic process of physically inspecting and validating tangible assets against the asset register or accounting records. The goal is to confirm each asset’s existence, location, user and condition, to ensure the records (like the Fixed Asset Register) match reality.

This process gives tangible evidence that assets aren’t just items on a spreadsheet. It involves checking on-site that the assets listed in your books are present and in good order, then reconciling any differences between the physical count and the records.

Case Study

Read how AssetCues benefitted one of the leading chemicals and fertilizers company in saving more than 70% time and cost in performing physical verification of assets

Case Study

Read how AssetCues benefitted one of the leading chemicals and fertilizers company in saving more than 70% time and cost in performing physical verification of assets

Looking for these Features-

Assetcues- Fixed Asset Management Software checks all the boxes

Why is Asset Verification Important?

Performing asset verification regularly brings a host of benefits and risk reductions. Below are key reasons why asset verification is critical for any organization that owns significant fixed assets:

Accurate Financial Reporting:

Verifying assets ensures your balance sheet reflects only real assets. This prevents “ghost assets” (items on books that don’t exist) from inflating asset values. Up to one-third of listed assets in some companies may be ghost assets, which can distort financial results. Regular verification cleans out these inaccuracies, so depreciation and book values are based on actual assets.

Audit Readiness and Compliance:

Asset verification supports internal controls and ensures compliance with legal and financial regulations. Companies verify fixed assets annually to align with standards like IFRS and GAAP. This process confirms asset existence and satisfies external auditors during financial reviews. Verification also protects your business by supporting the audit’s existence assertion.

Loss Prevention (Theft and Misuse):

Physically auditing assets deters theft and uncovers missing items early. If equipment disappears, a verification will flag it, allowing investigation. According to one report, nearly one-third of employees commit some form of theft. Without Asset Verification procedures, missing assets might go unnoticed for long periods, enabling misappropriation. Regular audits also identify idle or underutilized assets, so they can be redeployed instead of unnecessarily buying new ones.

Optimized Asset Utilization and Planning:

Verified asset data helps identify underutilized or idle assets. Companies can redistribute resources effectively and avoid unnecessary asset purchases. This leads to cost savings. Moreover, up-to-date records support accurate financial valuations and informed CapEx decisions. During audits or mergers, verified asset records ensure no surprises. They prevent any inflated values.

In short, asset verification underpins trustworthy financial reporting, operational integrity, and compliance. It’s like a safety net that catches errors or fraud before they snowball into major problems. This process ensures assets on the balance sheet “actually exist, are in good condition, and are where they’re supposed to be”.

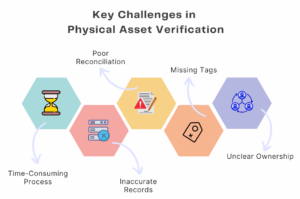

Common Challenges in Physical Asset Verification

If asset audits were easy, every organization would do them frequently. In reality, physical asset verification can be challenging, especially for large enterprises. Here are some common hurdles and pain points professionals encounter:

Time-Consuming Process:

Manually verifying hundreds or thousands of assets across locations is time-consuming and requires significant effort. Moreover, coordinating a wall-to-wall inventory often disrupts operations and affects daily business activities. Consequently, extensive inventories usually lead to delays and inefficiencies when organizations rely on manual processes.

Inaccurate or Outdated Records:

Asset registers that aren’t up-to-date make verification harder. If assets were moved or disposed of but not recorded, the team wastes time searching for things that aren’t there. Discrepancies arise from missed updates after asset transfers or data entry errors, complicating the reconciliation process.

Improper Asset Identification:

If assets lack proper labels or tags (barcode stickers, RFID tags, etc.), verifying them is difficult. You might not tell which machine is which, leading to confusion and errors. Worn-out or missing tags are a common issue. Without unique identifiers, auditors can’t easily match physical items to record entries.

Geographically Dispersed Assets:

Organizations with assets spread across large sites or multiple locations face logistical challenges. Some assets are in hard-to-reach places (like equipment on remote sites or secure facilities), making them difficult to verify. Scheduling visits and physically accessing each item can be tricky if sites are far-flung.

In summary, physical asset audits are logistically complex. They require careful planning, coordination, and tools to overcome these challenges. Fortunately, as we’ll discuss, there are strategies and technologies (like mobile scanning and automated reconciliation) to make the job easier and more accurate.

Read how to choose the right asset verification company for your organization>>

Asset Verification Methods (Wall-to-Wall vs. File-to-Floor)

There are two primary approaches to conducting physical asset verification. Choosing the right method depends on the state of your asset records:

1. Wall-to-Wall (W2W) Asset Verification

- Objective: “Start from scratch.” This method aims to establish or update a complete asset register from the ground up. It’s used when current records are unreliable or nonexistent.

- Process: Every asset in the organization is physically located and recorded, whether or not it’s in the existing register. Essentially a full sweep, tagging and documenting each asset afresh. It covers all assets wall-to-wall.

- Use Case: Ideal for first-time verifications or when records are in disarray. For example, if a company has grown via acquisitions and lacks a consolidated asset register, a W2W verifies everything and creates a baseline. It is time and labor intensive but comprehensive.

2. File-to-Floor (FTF) Asset Verification

- Objective: “Validate the books.” This method cross-checks existing records against actual assets. It assumes your fixed asset register is in place and reasonably reliable.

- Process: Take the asset register (“file”) and verify each listed asset on the “floor” (physical location). Mark assets found, note any listed but not found (missing) and any found but not listed (unrecorded additions) assets. Essentially, you’re auditing the register’s accuracy.

- Use Case: Best for organizations with a maintained asset register. It’s more efficient since you’re focusing on recorded items. For example, in annual audits, companies often use FTF to ensure no assets have “vanished” or been erroneously left on the books.

“If your records are a mess, start with W2W to reset the system; if not, an FTF periodic check might suffice. In some cases, a hybrid approach can be used: do a W2W every few years and FTF in between.”

Understand the asset verification methods and their differences in detail >>

Fixed Asset Verification Process (Step-by-Step)

Despite the challenges, following a structured process can make asset verification manageable. The asset verification process may differ slightly based on the asset verification method (W2W or F2F), but broad steps remain the same.

Here’s a step-by-step guide to the asset verification process, which can serve as a blueprint for conducting a physical asset audit:

For a detailed reading – Click on “Fixed Asset Verification Process – A step by step guide for success”

Planning and Preparation:

First, define the verification scope and objectives clearly to guide the entire audit process. Then, decide which locations and asset categories to include—or plan a full wall-to-wall inventory. Next, assign the verification team with clear roles for counting, supervision, and reconciliation tasks. Finally, set the audit schedule, gather tools, and notify departments to ensure cooperation and asset availability.

Physical Verification:

Visit each asset location and perform the physical count. Locate each item on the list and verify its existence and condition. Tag the asset with a barcode or RFID tag (or mark it off manually) as you identify it. In case assets are already tagged, scan them using a mobile application. Note any asset found in the location that is not on your list, and any listed asset that is missing

Reconciliation and Updating Records:

After completing the count, compare the on-site findings with the fixed asset register. Identify any discrepancies:

- Missing assets – items recorded in the register that were not found physically.

- Extra assets – items found on-site that aren’t in the register.

- Mismatched data – differences in asset details (location, status, etc.).Asset Reconciliation – Key to Successful Asset Verification

Investigate each discrepancy:

Check disposal or transfer paperwork to identify reasons for missing physical assets during verification. Then, review purchase records to find unlisted items not added to the asset register. Ask department managers about equipment that appears missing and resolve all discrepancies promptly. Finally, update the asset register and financial records, removing or correcting assets as needed for compliance.

Reporting and Next Steps:

Document the verification findings in a formal report. Include an overview of the process (what was verified, when, by whom), a summary of discrepancies (e.g. X assets not found, Y new assets identified), and the corrective actions taken (records updated, assets tagged, etc.). Have this report reviewed and signed off by management or auditors as an audit trail. Use the results to improve asset controls (for example, implement better tagging or security for assets).

Download the Fixed Asset Verification Checklist

Get a ready-to-use checklist to streamline your next Wall-to-Wall or File-to-Floor audit.

Download the Fixed Asset Verification Checklist

Get a ready-to-use checklist to streamline your next Wall-to-Wall or File-to-Floor audit.

Barcode and RFID: Automating Physical Asset Verification with Speed and Accuracy

Manual asset audits are slow, error-prone, and hard to scale. That’s where barcode and RFID technologies revolutionize the physical asset verification process. These asset tagging methods allow fast, accurate scanning of assets, drastically reducing manual effort.

Both technologies improve accuracy, support regulatory compliance, and reduce audit fatigue. They’re particularly useful when integrated with asset verification software like AssetCues. AssetCues supports both barcode and RFID scanning through its mobile app—making verification seamless and real-time.

By tagging your assets and scanning them digitally, you can cut audit time by 70%, minimize errors, and always stay audit-ready.

Manual workload and growing compliance pressures are pushing accountants to the brink. Gartner research reveals that over one-third of accountants make multiple financial errors per week—often due to outdated processes and limited capacity.

Tools to Simplify Asset Verification

Modern technology has transformed fixed asset verification, making it significantly faster and more accurate. Gone are the days of tracking assets manually with pen and paper. Today, finance and audit teams use digital tools to simplify and streamline the process. Here are some key technologies and strategies professionals now rely on for efficient physical asset verification:

Asset Tagging Systems:

As a foundation, each asset should carry a unique identifier. Asset tagging typically uses barcode labels or RFID tags attached to assets. Scanning a barcode or RFID tag allows instant identification of an asset in the register. Using these tags can increase tracking accuracy and cut audit time significantly. Tagging also ensures no asset is overlooked or mistaken for another.

Mobile Asset Verification Apps:

Intuitive mobile apps let your team carry and update the asset register while on the move. Auditors can scan asset tags using a smartphone, verify details, and add notes instantly. They can also capture photos or note asset conditions directly at the physical location. For example, AssetCues offers a user-friendly mobile app designed specifically for asset audits. Even non-IT staff can easily scan, verify, and record assets in the field with minimal training.

ERP Connectors:

ERPs like SAP, Oracle and Microsoft maintain the asset register, and when integrated with asset verification software, they update in real-time as assets are scanned and audited. Automation means no more Excel spreadsheets or error-prone manual reconciliation. Enterprise-grade products (like AssetCues) come with prebuilt ERP connectors (SAP, Oracle, Microsoft), enabling seamless data flow between your asset tracking system and financial ledgers.

AI-Powered Analytics:

Newer asset management solutions incorporate image recognition AI and machine learning to enhance verification accuracy. AI can help detect anomalies – for example, if an asset photo does not match the description, the system can alert you to double-check that item. While still emerging, such AI-powered audit accuracy features aim to catch what humans might overlook and ensure nothing falls through the cracks.

Modern asset verification tools thus make the process faster, more accurate, and audit-ready. Now, let’s look at an example solution that brings these elements together.

Example Solution: AssetCues for Asset Verification

One enterprise solution that combines these capabilities is AssetCues. AssetCues is an enterprise-grade fixed asset management platform built by Chartered Accountants/CPAs to make asset verification and tracking effortless. Key strengths of AssetCues include:

Highly intuitive mobile application:

The AssetCues mobile app makes on-site asset audits simple. Auditors can scan barcodes or QR codes with a smartphone, add photos, and verify details in seconds. The app’s user-friendly interface requires minimal training.

Prebuilt ERP connectors (SAP, Oracle, Microsoft):

AssetCues integrates with major ERP systems out-of-the-box. Asset data flows seamlessly between AssetCues and your ERP, ensuring the finance team’s records update automatically after a physical audit. No more manual data transfers.

AI-powered audit accuracy:

The platform leverages AI to detect anomalies and boost audit accuracy. For example, it can flag unusual changes (like an asset’s photo not matching the asset name) for review. This AI oversight acts as an extra set of eyes, reducing errors and missed discrepancies.

Enterprise-grade product:

AssetCues is built to handle large-scale asset tracking. It supports millions of asset records, multi-location and multi-user scenarios, with robust security and permission controls – essential for big organizations. It’s a proven solution used by Fortune 500 companies globally.

Domain expertise:

Because it’s built by finance professionals (Chartered Accountants/CPAs), AssetCues follows best-practice accounting controls. It aligns with financial reporting requirements out of the box (handling depreciation, asset capitalization, audit trails, etc.).

Scale and performance:

AssetCues tracks over 10 million assets worldwide, demonstrating its scalability. Whether you have 100 or 100,000 assets, the system can handle it. Many Fortune 500s trust AssetCues to keep tabs on their far-flung asset base.

Global implementation experience:

With Fortune 500 clients across industries and countries, AssetCues has been battle-tested in various compliance frameworks and business environments. Its flexibility allows it to adapt to different needs while maintaining high reliability.

In essence, AssetCues brings together all the elements needed for smooth asset verification – tagging, mobile scanning, ERP integration, and intelligent analytics – in one platform. For organizations looking to modernize their fixed asset audits, solutions like AssetCues offer a turnkey approach that saves time and boosts confidence in the results.

(Note: The above is an example solution. Always evaluate multiple options and choose software that best fits your organization’s requirements.)

Ready to simplify your asset verification process ?

Schedule a free demo of AssetCues today and see how our platform can help you streamline audits, reduce errors, and stay audit-ready.

Looking for these Features-

Assetcues- Fixed Asset Management Software checks all the boxes

Conclusion

Fixed asset verification might not be the most glamorous task; however, it is undeniably a crucial safeguard for any business with significant physical assets. By ensuring that every asset on the books is verified on the ground, companies not only protect themselves from financial errors but also avoid regulatory non-compliance and operational inefficiencies. Throughout this guide, we have walked through the what, why, and how of asset verification — starting with its importance in confirming asset existence and accuracy, then moving through the step-by-step process, and finally exploring the tools that make it easier.

The key takeaway is that asset verification is not a one-time checkbox for auditors – it should be an integral, recurring part of asset management. Businesses that do this well reap the rewards: cleaner financial statements, better asset utilization, fewer losses, and smoother audits. A diligent verification routine also fosters transparency and trust in the numbers.

In closing, if your finance or audit team hasn’t revisited your asset verification approach in a while, now is a great time. Strengthen your controls, leverage new tools, and make sure no asset is left unaccounted. And if you’re looking for a partner in this journey, consider exploring solutions like AssetCues to transform how you track and audit your fixed assets. With the right processes and technology in place, fixed asset verification becomes not just a compliance exercise, but a source of confidence and insight for your entire organization.

Fixed Asset Verification FAQs

Q1: Which assets can be physically verified?

A: Physical verification applies mainly to tangible assets—those you can see and touch, like equipment or vehicles. Intangible assets, such as patents or trademarks, cannot be physically verified due to their non-physical nature. Instead, auditors verify them through supporting documents and appropriate valuation methods. This ensures all assets, tangible or not, are properly accounted for and reported.

Q2: What does an auditor check in verification of a fixed asset?

A: An auditor verifying fixed assets checks their existence, condition, status, ownership, and proper valuation. Additionally, they ensure the assets are accurately disclosed in financial statements. Essentially, the auditor confirms the assets are real, owned by the company, and correctly accounted for. This process strengthens trust in financial reporting and ensures regulatory compliance.

Q3: What does verification of assets mean?

A: Verification of assets means confirming that a company’s reported assets actually exist and are recorded correctly. It involves systematically validating each asset’s presence, location, and physical condition. Additionally, the process checks whether key details like cost and asset ID match the records. This ensures accuracy, supports compliance, and strengthens financial accountability.

Q4: What is verification of assets in auditing?

A: In auditing, asset verification involves procedures to confirm the existence, rights, and value of assets. Auditors may physically inspect assets where feasible to ensure they actually exist. Additionally, they examine supporting documents like invoices and ownership papers for validation. They also reconcile the asset register with the general ledger to ensure consistency. As a result, these steps help verify that reported assets are accurate and audit-compliant.

Q5: How often should fixed asset verification be done?

A: The frequency can vary, but a common best practice is to do a full physical verification at least once a year. Many organizations align it with the annual financial audit. However, for large companies or those with highly movable assets, more frequent checks. Regular verification ensures issues are caught early and asset records remain accurate year-round.

Q6: What are asset verification services?

A: Asset verification services are professional services offered by third-party firms to conduct physical asset audits on behalf of an organization. Instead of handling verification internally, companies often hire experts for asset verification. These specialists bring advanced tools and experience to check and count physical assets. As a result, they reconcile assets efficiently with the company’s fixed asset register.

Q7: How can software help in fixed asset verification?

A: Asset verification software streamlines the process by digitizing the entire asset register. It enables teams to use handheld devices to scan tags and log data instantly. As a result, the software flags missing assets or discrepancies automatically during verification. This eliminates the need for tedious manual comparisons and speeds up the workflow. Moreover, it transforms a labor-intensive audit into a more automated and efficient process. Many tools also offer analytics to highlight patterns, improving long-term asset control.

About Author