Asset verification methods (also called physical verification methods) are approaches used to confirm that an organization’s assets actually exist, and validate them against the fixed asset register.

Two primary methods are widely used: Wall-to-Wall (W2W) and File-to-Floor (FTF) asset verification. Each method serves a different purpose and suits different situations. Choosing the right approach helps maintain an accurate asset register and ensures regulatory compliance in audits.

For a comprehensive walkthrough of planning and conducting a fixed asset verification, see our “Fixed Asset Verification: A Complete Guide to Physical Asset Audits”.

Let’s explore the two key asset verification methods – Wall-to-Wall and File-to-Floor – and how to use them effectively.

Wall-to-Wall Asset Verification (W2W – Complete Inventory from Scratch)

Wall-to-Wall (W2W) verification is a comprehensive physical audit of all assets, essentially “starting from scratch.” In a W2W exercise, you don’t rely on any existing asset list. Instead, you physically locate and record every asset wall-to-wall. As a result, you create a completely fresh asset register. This method offers the most thorough verification. However, it also requires the most time and effort.

When to Use Wall-to-Wall Verification

Wall-to-Wall verification is ideal in scenarios where current asset data is unreliable or nonexistent. You might choose W2W when:

- Records are Unreliable: If your asset register is full of errors or outdated entries, a clean-slate count fixes it.

- No Prior Register: If the company never had a proper fixed asset register (e.g. a first audit or after years of neglect), W2W establishes the baseline.

- After Major Changes: Following mergers, acquisitions, or a disaster, you have many new or moved assets. A W2W audit consolidates and verifies everything you now own.

- Periodic Reset: Some organizations do a W2W every few years as a reset, especially if minor discrepancies have accumulated over time.

Benefits:

A Wall-to-Wall approach gives a complete and accurate snapshot of all assets. It uncovers any “surprise” assets or missing items you never recorded. This improves record accuracy, enhances security (you now know exactly what exists and where), and simplifies budgeting and maintenance planning with reliable data.

Accurate records also ensure depreciation is calculated correctly – read our blog on the “Impact of Asset Verification on Depreciation Accuracy” to understand how verification affects financial reporting. It also makes subsequent audits smoother since you’ve verified from the ground up.

📊 Insight: According to the PwC Assurance Transformation Study, 71% of companies say providing auditors with documentation is the most time-consuming part of audits. This reinforces the importance of having an up-to-date, verified asset register to reduce audit prep time and friction.

File-to-Floor Asset Verification (FTF – Cross-Checking Recorded Assets)

File-to-Floor (FTF) verification is a cross-check audit of existing asset records against physical assets on the ground. In this method, you start with the “file” – your fixed asset register / listing – and verify each listed asset on the “floor” (the actual location). Essentially, FTF asks: “Does physical reality match the records?” It’s often used when you have a reasonably maintained asset register and want to ensure it stays accurate.

When to Use File-to-Floor Verification

File-to-Floor is appropriate when you trust your records to some extent, and need to validate or update them. Use FTF when:

- Regular Accuracy Checks: You have an asset register in place and want to maintain its accuracy. Routine FTF audits (e.g. annually) will catch discrepancies like missing or unrecorded assets before they escalate.

- Preparing for Audit: Before a financial audit or year-end, doing an FTF verification helps ensure the books reflect reality. By fixing discrepancies beforehand, the official audit is less likely to find issues. You can read more about this in our article on “Verification of Assets during an Audit”, which details what auditors look for and how to stay compliant.

- Post-Implementation Reviews: If you implemented a new asset management system or software like AssetCues, an FTF exercise confirms that the data migrated or entered is correct and matches actual assets.

- Cost-Control Initiatives: When aiming to cut costs, start by verifying recorded assets. This helps confirm their existence and current condition. As a result, you can identify unused assets for redeployment. Alternatively, you may find assets that need disposal. Therefore, you improve overall asset utilization.

Benefits:

File-to-Floor is efficient because it focuses on verifying recorded items rather than finding everything from scratch. It saves time by quickly highlighting exceptions. First, you identify listed assets that you can’t find. These assets may have been disposed of or stolen. Next, you detect assets found but not on the list. These could be new acquisitions not yet recorded.

This method keeps your asset register up-to-date and gives high confidence in financial reports with less effort than a full W2W. Any mismatches or exceptions can be resolved through a structured Asset Reconciliation process to ensure the records fully align with reality. It’s an excellent way to ensure audit readiness continuously, as discrepancies are corrected in the normal course of business.

Wall-to-Wall vs File-to-Floor: Key Differences and Choosing the Right Method

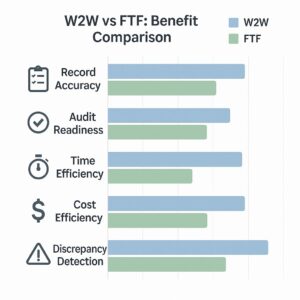

Both W2W and FTF methods aim to ensure accurate asset records, but they differ in approach and use-case. The choice often depends on the quality of existing records and the organization’s goals. Below is a quick comparison:

| Aspect | Wall-to-Wall (W2W) | File-to-Floor (FTF) |

| Starting Point | No reliable prior data needed – begin fresh by counting all assets. | Begins with an existing asset register as the reference. |

| Scope | Full inventory of every asset (100% sweep). Comprehensive but time-intensive. | Targeted verification of recorded assets. Efficient, focuses on discrepancies. |

| Purpose | Create or rebuild asset records when data is missing or doubtful. Establish a baseline. | Validate and update an existing asset register to maintain accuracy over time. |

| Ideal Scenarios | First-ever asset audit; post-merger or post-disaster inventory; records in disarray. | Conduct annual or periodic audits when you maintain records, and perform a preparatory check before financial audits. |

| Frequency | Infrequent – typically one-off or spaced years apart (due to effort required). | Frequent – can be done yearly or more often as part of regular controls. |

| Outcome | New, cleaned-up asset register; all assets tagged and accounted for. | Updated asset register with discrepancies corrected; high confidence in records. |

In practice, these methods are complementary. If your records are very poor, you start with a Wall-to-Wall to “reset” the system. Once you set a baseline, you can perform regular File-to-Floor verifications to keep records accurate going forward.

Many organizations adopt a hybrid approach: for example, perform a full W2W audit every 3–5 years, with annual FTF checks in between. This way, you balance the thoroughness of W2W with the efficiency of FTF. The key is to assess your situation: new or untrustworthy records = W2W; established records that need checking = FTF.

Conclusion

Asset verification is a foundational practice for robust asset management and financial integrity. No matter which method you use, the goal is the same – verify existence, correct any record errors, and ensure every asset is properly accounted for.

Remember: The ultimate goal is trustworthy asset data. With the right method (W2W vs FTF), a solid process, and possibly the help of specialized software or AssetCues’ expert services, you can keep your asset records fully aligned with reality. This not only safeguards your financial reports but also turns asset management into a strategic advantage for your organization.

Perform Fast and Accurate

Physical Verification – Every Time

AssetCues has helped transform asset verification and reconciliation

process for many Fortune 500 companies

Perform Fast and Accurate Physical Asset Verification - Every Time

AssetCues has helped transform asset verification and reconciliation processes for many Fortune 500 Companies.

FAQs

Q1. How does File-to-Floor (FTF) asset verification differ from Wall-to-Wall (WTW)?

Ans: FTF verification starts with existing records and reconciles them with physical assets. It ensures the listed assets are present and highlights any exceptions. WTW verification begins from scratch by counting and recording all assets without using prior records. WTW provides a more exhaustive approach, while FTF offers a more focused and quicker method for maintaining ongoing accuracy.

Q2. How often should physical asset verification be performed?

Ans: It depends on the organization, but at least once a year is a common practice. Many companies do an annual verification of fixed assets to sync records with reality. If you have a large number of assets or high turnover, consider semi-annual or quarterly checks for critical items. The important thing is that verification is done at reasonable intervals – enough to catch issues early and satisfy auditors that assets are routinely checked.

Q3. How can asset verification software or technology help in this process?

Ans: Organizations typically conduct verification at least once a year. Many companies perform an annual verification of fixed assets to sync records with reality. If they manage a large number of assets or experience high turnover, they may schedule semi-annual or quarterly checks for critical items. The key is to verify assets at reasonable intervals – often enough to catch issues early and assure auditors that they routinely check assets.

Q4. How are assets verified?

Ans. Assets are verified through physical audits using either the Wall-to-Wall (W2W) or File-to-Floor (FTF) method. Both methods involve on-site inspection, tagging (often using barcodes or RFID), data capture via software like AssetCues, and reconciliation with records. This helps you account for all assets, assign correct values, and stay compliant with audit and depreciation standards.. You can learn more in our blog on the Fixed Asset Verification Process, which outlines each step in detail.

About Author