Introduction

Accurate depreciation calculation is critical to a company’s financial reporting, influencing not just profitability and asset valuation but also compliance with tax laws and accounting standards like International Accounting Standard (IAS) 16 and Accounting Standards Codification (ASC) 360. These standards require that depreciation accurately reflects the economic wear of assets over time. Physical asset verification plays a key role here, as it removes “ghost assets” from the books and prevents depreciation from being calculated on assets that no longer exist.

Yet, the accuracy of these calculations can easily be compromised if the foundation—an accurate, up-to-date asset register—is flawed. Without consistent physical verification of assets, even the most carefully planned depreciation schedules may mislead, reflecting assets that are no longer present, damaged, or used differently than assumed in the financial records. Regular fixed asset verification helps ensure depreciation is based on assets that truly exist and are correctly recorded.

In this guide, you will learn:

- Why accurate depreciation calculation depends on regular physical asset verification and an up-to-date asset register.

- How IAS 16 and ASC 360 compliance relies on correct asset existence, condition, and useful life.

- How automation (barcodes, RFID, mobile tools) improves depreciation accuracy and audit readiness.

Given the role of IAS 16 and ASC 360, both widely used frameworks, companies are required to maintain reliable records for Property, Plant, and Equipment (PP&E) to meet specific standards:

-

Accurate Depreciation Accounting

Calculations should be based on the asset’s actual, remaining useful life and align with its current condition and operational status.

-

Timely Impairment Assessments

Where assets have diminished in utility before their anticipated end of life, impairment assessments are necessary to adjust depreciation or the asset’s book value.

-

Internal Control and Reconciliation

Consistent reconciliations of asset verification and robust internal controls ensure that assets represented in financial statements truly reflect the company’s holdings, location, and usage.

Beyond compliance with IAS 16 and ASC 360, accurate depreciation calculation also supports tax obligations, as tax authorities require companies to follow specific depreciation schedules. Mistakes in asset records, such as those caused by inaccurate or outdated asset information, may lead to reporting errors, overstatements, or understated tax liabilities—all of which can result in non-compliance and incur penalties.

Depreciation calculations are only as accurate as the asset data behind them. Without regular physical verification, companies record assets that no longer exist, are damaged, or misclassified, creating compliance and tax risks.

Factors that impact the calculation of Depreciation

In many cases, companies assume their accurate depreciation calculation are based on past comparisons rather than true asset verification. Management and auditors often rely on year-over-year alignment, which only confirms that depreciation is consistent—not that it is accurate. In practice, if current depreciation aligns with the previous year’s figures after accounting for additions and disposals, people often accept it without question. However, such assumptions can mask deeper errors, especially if assets are no longer in service, have been disposed of, or have become obsolete.

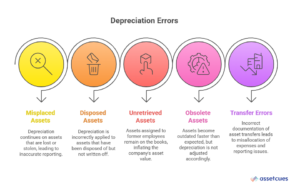

Physical verification of PP&E brings these errors to light. For instance, a physical count can identify assets that are misplaced, stolen, transferred, or damaged. Without such verification, assets that no longer serve any operational purpose may still be listed, accumulating unnecessary depreciation expense. Here are some common errors that affect depreciation accuracy:

-

Misplaced or Stolen Assets

If an asset is missing but still recorded, the company continues to expense depreciation, resulting in inaccurate reporting and overstated expenses.

-

Disposed Assets Not Written Off

Leaving disposed assets in records causes ongoing depreciation, which skews profit and loss statements

-

Unretrieved Employee Assets

Assets assigned to former employees but not recovered can linger in records, showing as available even if they no longer serve the company.

-

Obsolete Assets

With rapid technological changes, assets may become obsolete well before the end of their expected life. Failing to adjust accurately overstates the asset’s useful life.

-

Asset Transfers Not Updated

When assets change locations or cost centers, inaccuracies arise if not documented correctly, leading to misallocation of expenses and complications in segment reporting.

Inaccurate depreciation often stems from outdated asset records—such as disposed, misplaced, or obsolete assets still on the books. Physical verification exposes these hidden errors and prevents overstated expenses and misstated profits.

By conducting regular physical asset verification, companies can address these discrepancies and ensure depreciation schedules reflect actual asset usage. In many cases, working with a reliable asset verification company helps confirm that assets listed in financial statements truly exist, are in use, and are recorded accurately.

The Role of Physical Asset Verification in Accurate Depreciation Calculation

Physical Asset Verification is an essential step for maintaining PP&E accuracy, helping to identify issues such as ghost assets, zombie assets, and unaccounted-for items that distort financial data. A well-organized physical asset verification process enables companies to validate assets, ensuring they align with the company’s records and adjusting depreciation schedules as needed.

-

Ghost Assets

These assets appear in the financial records but do not exist physically. As a result of loss, theft, or unrecorded disposal, companies overstate asset values and depreciation expenses.

-

Zombie Assets

These are assets that are physically present but do not appear in the asset register. Organizations must add often-overlooked zombie assets to asset records for accuracy. Identifying and recording these assets properly ensures compliance and valuation accuracy, keeping all owned assets accounted for.

-

Damaged or Obsolete Assets

Physical Asset verification allows companies to assess asset conditions, supporting necessary adjustments to their useful lives or additional repairs. For example, a production asset in a heavily used area may experience more wear than initially expected, requiring a revised depreciation rate to reflect its economic value accurately.

Physical Asset Verification also strengthens internal controls by reconciling asset locations and conditions and verifying accurate cost center updates. Accurate asset location and cost center updates ensure precise cost allocations and segment reporting, preventing discrepancies that affect the company’s financial picture.

Automated Physical Asset Verification for Accuracy of Depreciation and Asset Valuation

Automated verification using barcodes, RFID, IoT, and mobile apps ensures real-time asset visibility. This minimizes manual errors, supports IAS 16 and ASC 360 compliance, and keeps depreciation calculations accurate year-round.

While physical asset verification is essential, manual tracking processes are labor-intensive and prone to error. Automation offers a more efficient and accurate approach, transforming asset management into a seamless, real-time process.

-

Barcode Systems

Barcodes enable fast, error-free asset identification, allowing staff to scan assets in real time. This streamlined approach minimizes errors in manual data entry and ensures accurate documentation of every asset in the asset register.

-

RFID (Radio-Frequency Identification)

RFID tags scan without direct line-of-sight, which is especially useful in large facilities. RFID tracks asset movements and locations, ensuring accurate records across sites and cost centers.

-

GPS and IoT Sensors

Using GPS and IoT sensors, companies can continuously monitor assets’ locations and conditions. IoT sensors detect asset changes, alerting managers and reducing depreciation errors from unrecorded damage or misplacement.

-

Mobile Applications

Mobile asset tracking applications allow on-the-go asset condition and location updates. When linked to cloud-based asset systems, mobile tools enable instant uploads, giving real-time updates that improve verification accuracy.

Automation not only strengthens compliance with IAS 16 and ASC 360 but also supports accurate depreciation calculation and tax reporting. Automated systems deliver real-time data to track assets, verify presence, and keep records aligned with operations. Hence, reduces errors and eases asset verification, helping companies stay compliant and maintain accurate records.

Key Takeaways

Conclusion

Accurate asset depreciation calculations require a solid foundation. In this context, physical asset verification and automation tools are indispensable, as they ensure asset records truly reflect the company’s physical holdings and condition. Moreover, maintaining accurate PP&E records ensures compliance, reliable reporting, and minimizes tax risks. As a result, this leads to a more reliable representation of the company’s financial health.

FAQs

Q1. How to calculate actual depreciation?

Ans: Actual depreciation is calculated by subtracting an asset’s residual value from its cost, then dividing that amount by the asset’s useful life. The most common formula is: Depreciation = (Cost – Salvage Value) ÷ Useful Life.

Accurate depreciation tracking helps businesses reflect the true value of assets, improve financial reporting, and plan timely replacements.

Q2. What is the most accurate method of depreciation?

Ans: The straight-line method is often considered the most accurate and widely used approach for calculating depreciation. It spreads the asset’s cost evenly across its useful life, offering clarity and consistency in financial statements. For assets that lose value faster in the initial years, methods like declining balance or sum-of-the-years’ digits can provide more precise results.

Q3. How does verifying assets improve depreciation accuracy?

Ans: Verifying assets ensures depreciation is calculated only on assets that physically exist and are in use, helping eliminate errors caused by ghost assets (assets recorded in books but not actually present) and ensuring accurate financial reporting.